The Stock Exchange of Hong Kong (HKEx) published a Research Report: Hong Kong’s ETF Market as a Door to Global Investment in September 2019 highlighting Hong Kong’s potential as Asia’s exchange traded funds (ETF) marketplace for the issue and trading of ETFs. With limited ETF coverage of global assets in the Mainland China market, the Report notes that the diverse products and investor base of Hong Kong’s ETF market is likely to be attractive to Mainland Chinese investors who have shown growing interest in ETF investments. Conversely, the variety of ETFs on Mainland assets in the Mainland China market is likely to be attractive to global investors in Hong Kong. The HKEx Report thus sees potential for developing Mainland-Hong Kong ETF market connectivity, including the possibility of mutual market access for ETFs, as likely to be conducive to the mutual growth of both the Hong Kong and China markets.

Global ETF Market

An ETF is an investment fund traded on a stock exchange which holds assets such as stocks, commodities, or bonds. Over the past decade, there has been phenomenal growth in ETFs. 5,138 ETFs were listed globally in August 2017, more than four times the number listed in 2007.[1] Global ETF assets under management grew from approximately US$807 billion in 2007 to US$4.2 trillion as at the end of August 2017.[2]

ETF growth rates vary across markets. In the US, there were 1,776 ETFs with aggregate AUM of US$3 trillion as at the end of August 2017, representing a compound annual growth rate (CAGR) of 18.4% over the past 10 years.[3] In Europe, ETF AUM grew from US$132 billion in 2007 to US$695 billion in August 2017, at a CAGR of 18.7%.[4] In the Asia-Pacific region, the number of ETFs constituted 22% of the number of ETFs globally and their AUM stood at US$382 billion in August 2017, a CAGR of 20% from 2007.[5]

Ernst & Young’s global ETF research (Global ETF Research) predicts that global ETF assets could reach US$7.6 trillion by the end of 2020 – equivalent to a CAGR of approximately 18% – underpinned by the shift to passive investments, the size of ETFs relative to the overall market and ETFs’ suitability for digital distribution. EY’s Global ETF Research concludes that almost every recent investment trend has worked in favour of ETFs, including global themes such as the shift to self-directed retirement saving, economic factors such as low yields, regulatory efforts around suitability and value for money, technological developments such as digital distribution, and investment themes such as the “shift to passive”.[6]

Hong Kong ETF Market

Hong Kong has successfully established itself as one of the leading ETF markets in Asia since ETFs were first introduced to the Hong Kong market nearly two decades ago. Hong Kong is the second largest ETF market in Asia in terms of market capitalisation and the fourth largest in terms of ETF turnover. In the past 10 years, the market capitalisation of ETFs listed in Hong Kong has grown more than three times from US$13.6 billion in 2007 to US$43.3 billion in June 2017,[7] while annual turnover has increased more than 10 times, reaching a record high of US$280 billion in 2015.[8] During the same period, the contribution of ETFs to the Hong Kong cash market’s turnover also grew nine times from 0.9% in 2007 to 8.2% in the first half of 2017.[9]

However, despite tripling in size over the past 10 years, Hong Kong’s ETF market remains small and lacks product diversification. 112 ETFs are listed in Hong Kong with assets of around $45 billion, but the five largest ETFs account for 71% of total assets (See Figure 1 below):[10]

|

Figure 1: Hong Kong ETF Products Ranking |

||

| Name of ETF | AUM ($bn) | Market Share |

| Tracker Fund of Hong Kong | 13.3 | 30% |

| Hang Seng Index ETF | 7.4 | 16% |

| Hang Seng China Enterprises Index ETF | 4.5 | 10% |

| ABF Pan Asia Bond Index Fund | 3.8 | 8% |

| iShares FTSE A50 China Index ETF | 2.9 | 7% |

Source: HKEx ETS Products Overview

Looking at individual asset classes, Hong Kong equity-focused ETFs account for the largest market share – nearly 50%, followed by China-focused ETFs. About 50 Hong Kong ETFs are focused on these two markets.

|

Figure 2: Hong Kong Top 10 ETF Asset Classes by AUM |

|||

| Asset Class | Number of ETFs | AUM | Market Share |

| Equity – Hong Kong | 8 | 21.1bn | 47.0% |

| Equity – China (Mainland China listed companies) | 29 | 7.9bn | 17.6% |

| Equity – China (Hong Kong listed companies) | 9 | 5.7bn | 12.7% |

| Fixed Income & Currency (including Money Market) | 7 | 4.3bn | 9.6% |

| Equity – US | 6 | 2.8bn | 6.3% |

| Equity – Asia | 5 | 1bn | 2.3% |

| Equity – Global | 7 | 386.9m | 0.9% |

| Equity – India | 2 | 331.8m | 0.7% |

| Equity – Vietnam | 1 | 324.4m | 0.7% |

| Equity – Europe | 8 | 227.6m | 0.5% |

Source: HKEx ETS Products Overview

The lack of diversification is also reflected in a survey conducted by Brown Brothers Harriman. Although a majority of Hong Kong investors plan to increase their ETF investments in the next 12 months, they would like to see more ETF products across different asset classes. 65% want to see more global fixed income products, while 63% want to see more currency-hedged products, as there are only two such ETFs listed in Hong Kong.[11]

The Shift from Active to Passive Investing

The vast majority of ETFs currently available are index funds (also known as passive investments). Passive investment managers seek to match the performance of a specific index, rather than to outperform it, by buying and holding all or a representative sample of the securities in the index. The advantage is that risk is spread broadly within a market, avoiding the losses that can follow a dramatic decline in any one specific company or industry sector.[12]

EY’s Global ETF Research suggests that passive funds will exceed active funds by 2027. There is a growing view that, after costs, very few active strategies consistently outperform index-based investments. ETFs should continue to benefit disproportionately, thanks partly to low fees and partly to market volatility, which often increase the appeal of ETF’s intraday liquidity. Recent political volatility in the US, the UK and elsewhere has given ETFs a further boost. For example, the highest ever days of UK ETF trading occurred immediately after the Brexit vote and the 2016 US presidential election. As passive investments continue to gather more inflows than active investment, ETFs will continue to be one of the greatest beneficiaries.[13]

Mainland China ETF Market and Demand for Diversification

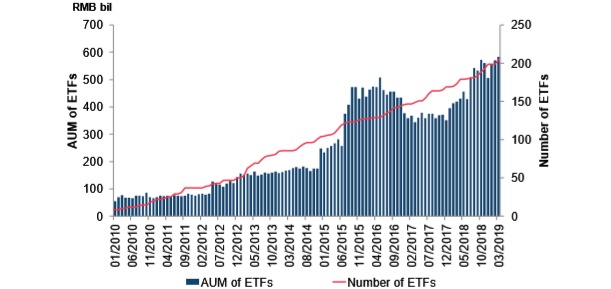

Mainland China’s ETF market has grown rapidly since the first ETF was listed on the Shanghai Stock Exchange (SSE) in February 2005, tracking the performance of the SSE 50 Index (an index for large-cap stocks listed on the SSE). Both the AUM and the number of ETFs in Mainland China reached record highs as of the end of the first quarter of 2019 ― 205 ETFs with a total AUM of RMB 583.1 billion (see Figure 3).[14] In line with growth in the Mainland China ETF market, 77% of Mainland China investors expect to increase allocations of ETFs in 2019, compared to 43% last year.[15]

Figure 3: AUM and number of ETFs in the Mainland (Jan 2010 – Mar 2019)

However, despite strong growth and optimistic expectations, all the listed funds in the Mainland are currently traded in RMB, which means that Mainland investors cannot diversify currency exposure by investing in Mainland ETFs. In the light of this, Mainland China’s exchanges are exploring ways to broaden exposure to global assets. Earlier this year, the SSE and the Japan Exchange Group (JPX) established the China-Japan ETF Connectivity Scheme (China-Japan ETF Scheme) to allow funds that target each other’s markets to be listed in both exchanges. On 25 June 2019, the SSE and JPX cross-listed the first batch of ETFs with underlying assets on each other’s market under the China-Japan ETF Scheme.[16]

Mainland Chinese investors may demand investment diversification through ETFs. Rising interests in ETFs from Mainland investors were observed from the growing market size and trading activities of the Mainland ETF market. However, Mainland-listed funds are dominated by funds investing in domestic assets, and the supply of listed funds investing in global assets remains limited. In the light of this, Mainland investors would benefit from access to the Hong Kong ETF market which has greater exposure to global asset classes. Under the China-Japan ETF Scheme, a Japanese or Chinese ETF issuer establishes a different class of fund units called “feeder ETF” that invests in at least 90% of a target ETF listed on the other exchange, subject to quotas under the Qualified Foreign Institutional Investor (QFII) and Qualified Domestic Institutional Investor (QDII) schemes.[17]

Complementary Nature of the Mainland China and Hong Kong ETF Markets

Mainland China ETFs

In the Mainland, the growing interest in ETFs and the large number of ETFs focused on domestic assets, might suggest demand from Mainland fund investors for asset diversification. However, Mainland fund investors can only invest in global assets through funds under the QDII scheme and the mutual recognition of funds agreement with Hong Kong, as well as a few cross-listed Japanese ETFs. Hong Kong ETFs, on the other hand, cover a wide range of Asia-Pacific and overseas equities as well as other global asset classes, including fixed income, currency and commodities. These ETF products might be considered as alternatives for Mainland investors.[18]

As regards the investor base, retail investors dominate the Mainland market and account for about 99.6% of all investors.[19] The relatively small amount of institutional investor participation may limit the growth of trading activities in the ETF primary market (creation/redemption of ETF units), which is important to reduce the premium or discount to an ETF’s NAV, to achieve fair pricing of an ETF. The global institutional investor base in Hong Kong could be complementary to the investor base in the Mainland to support the growth of the Mainland ETF market.[20]

Hong Kong ETFs

Hong Kong is already an ETF marketplace with a wide range of asset classes covering Mainland Chinese and global assets. However, the range of Mainland asset classes is still somewhat limited. Take A-share ETFs as an example. About half of Hong Kong-listed A-share ETFs track the popular A-share indices in Mainland ― out of 25 A-share ETFs as of end-June 2019, 8 ETFs tracked the CSI 300 Index and 4 ETFs tracked the FTSE China A50 Index.[21] In comparison, Mainland A-share ETFs not only track the headline indices, but also different sector indices, ownership and smart betas (e.g. growth, value and dividend, etc.). Greater product diversification in the Hong Kong ETF market, e.g. through access to Mainland ETFs, could attract more offshore investors.[22]

As to ETF trading activities, ETF turnover in the Hong Kong market is somewhat concentrated on a relatively small number of products ― the five ETFs with the highest turnover value accounted for 90% of total ETF turnover value during the first half of 2019. It is possible that Mainland investors are interested in ETFs with investments across different asset classes. Opening access to the Hong Kong ETF market to Mainland investors could potentially drive growth in the secondary market trading activities of Hong Kong ETFs.[23]

Given the complementary nature of products and investors in the Mainland and Hong Kong markets, increased Mainland-Hong Kong market connectivity in the ETF market has the potential to satisfy investors’ different investment appetites and improve liquidity in the ETF primary and secondary markets.[24]

The Attractiveness of the Hong Kong ETF Market

The presence of a global investor base with increasing demand for ETFs

In 2018, 62% of the funding sources of asset and wealth management in Hong Kong came from global investors, including global asset managers with Asia-Pacific operations headquartered in Hong Kong. These global investors have been investing in Mainland securities through Hong Kong, which are facilitated by Stock Connect, Bond Connect, and the QFII and RQFII schemes. Optimism over the inclusion of A-shares into global indices would further accelerate inflows. Local institutions’ demand for ETF investments is also expected to rise. For pensions in Hong Kong, the AUM of Mandatory Provident Fund (MPF) schemes reached HK$813 billion as of end-2018 with an average yearly inflow of about HK$40 billion. The Mandatory Provident Fund Authority (MPFA) accepted 131 ETFs as index-tracking collective investment schemes into the investment scope of MPF schemes in Hong Kong.[25]

The rising number of market makers support market liquidity

In Hong Kong, ETFs are required to have at least one market maker. The number of ETF market makers, which can be proprietary trading firms or investment banks, increased from 14 in 2008 to 24 in 2012, and to 33 in 2018. Market makers make profits on arbitrage activities between the primary and secondary markets and their activities provide liquidity to secondary trading in ETFs. Market makers are obliged to input market making orders upon the occurrence of a “wide spread” lasting at least 3 minutes. Market making orders can range from 4 to 32 spreads depending on the ETF. Market makers must submit two-sided market making orders with 3 to 30 spreads (depending on the ETF) within 90 seconds for 3 minutes. In fact, certain ETFs are normally quoted to the tightest spread in accordance with the spread table. Tighter quotes can be provided if the tick sizes in the spread table can be reduced for ETFs, which have been suggested by market participants. Market making obligations help to even out the demand for redemption during market correction. For example, during the Mainland stock market correction in 2015, although there were major redemptions, redemption requests on ETF managers were met in an orderly manner without activating any redemption tools such as redemption suspension or gate.[26]

The “Trade Asia in Asia” trading philosophy highlights Hong Kong’s geographical advantage for ETFs on Asian underlying assets

In addition to time zone preference, asset managers in Hong Kong are experienced in investing in Asia-Pacific assets and over 65% of assets managed in Hong Kong were invested in Asia Pacific from 2014 to 2018. ETF liquidity tends to go with the availability of trading in the underlying assets due to hedging needs. The bid-ask spread, i.e. the trading cost, usually decreases with increasing liquidity. The bid-ask spread can be wider for US ETFs on underlying assets in international markets, which may be closed when the US market is still trading. When the underlying market is opened, ETF managers and market makers can hedge their risks in the underlying markets and are more willing to support the liquidity of the ETF. Otherwise, they need to rely on estimating the fair value when the underlying market is closed. Therefore, the liquidity of ETFs in Hong Kong on Asian underlying assets tends to be better than those in American and European time zones.[27]

Market-friendly regulation supports the issuance of a diverse range of ETFs

The Hong Kong market regulator, the Securities and Futures Commission (SFC), seeks to strike a balance between market development and investor protection. Since July 2017, the SFC has accelerated the authorisation of investment funds with the aim of reducing the processing time for an application to 2 months for “Simple Applications” and 6 months for “Complex Applications”. Since January 2019, the SFC has been willing to authorise active ETFs as well as passive ETFs. It also issued new provisions for UCITS funds (including ETFs domiciled in Europe) in December 2018 to provide more clarity on the cross-listing process, which has been streamlined since 2007. The SFC’s efforts of the regulator to support market growth are accompanied by the imposition of certain safeguards to protect ETF investors’ interests. For example, the SFC requires synthetic ETFs to have a marker “X” to be placed at the beginning of the short names and an asterisk (*) with an annotation of warning in English and Chinese, and imposes collateral requirements of at least 120% of gross counterparty risk exposure for equity collateral of synthetic ETFs.[28]

Report Conclusion

HKEx’s report summarises the distinctive features of Hong Kong and Mainland China ETF markets, and concludes that the two markets can offer mutual benefits to each other. The Hong Kong ETF market is a door to global investment for Mainland investors. It offers products on diversified asset classes from global markets and a well-established institutional investor base to support market liquidity. On the other hand, the breadth of exposure to Mainland China assets provided by Mainland China ETFs could be attractive to global investors. Further development of Mainland-Hong Kong market connectivity in the ETF sector, including mutual market access (subject to appropriate regulation) is thus likely to be conducive to the mutual growth of both markets.

[1] SFC, “Research Paper on Hong Kong ETF Market and Topical Issues in the ETF Space”. January 2018.

[2] Ibid.

[3] Ibid.

[4] Ibid.

[5] Ibid.

[6] EY, “Reshaping Around the Investor”. November 2017.

[7] SFC, “Research Paper on Hong Kong ETF Market and Topical Issues in the ETF Space”. January 2018.

[8] Ibid.

[9] Ibid.

[10] Fund Selector Asia, “What is Lacking in Hong Kong’s ETF Market?”. May 2018.

[11] Brown Brothers Harriman, “Shining Through: Global Investors Appear Confident in Multi-Faceted Use of ETFs”. February 2019.

[12] Vanguard, “Exchange Traded Funds (ETFs): Understanding Index ETFs and How They Work”. March 2016.

[13] EY, “Reshaping Around the Investor”. November 2017.

[14] HKEx, “Hong Kong’s ETF Market as a Door to Global Investment”. September 2019.

[15] Ibid.

[16] Bloomberg, “Japan and China Signed Agreement on ETF Cross-Investment Program”. April 2019.

[17] Ibid.

[18] SFC, “Research Paper on Hong Kong ETF Market and Topical Issues in the ETF Space”. January 2018.

[19] Reuters, “Retail Investors, Mid-caps Stand Out in China’s Stock Rally”. March 2019.

[20] HKEx, “Hong Kong’s ETF Market as a Door to Global Investment”. September 2019.

[21] HKEx, Source: “ETFs-List of securities for ETPs”. September 2019.

[22] HKEx, “Hong Kong’s ETF Market as a Door to Global Investment”. September 2019.

[23] Ibid.

[24] Ibid.

[25] Ibid.

[26] Ibid.

[27] Ibid.

[28] Ibid.

| Charltons | Boutique Transactional Law Firm of the Year 2017 Asian Legal Business Awards |

|

This newsletter is for information purposes only. Its contents do not constitute legal advice and it should not be regarded as a substitute for detailed advice in individual cases. Transmission of this information is not intended to create and receipt does not constitute a lawyer-client relationship between Charltons and the user or browser. Charltons is not responsible for any third party content which can be accessed through the website. If you do not wish to receive this newsletter please let us know by emailing us at unsubscribe@charltonslaw.com |

|

| Charltons Dominion Centre, 12th Floor 43-59 Queen’s Road East Hong Kong |

Tel: + (852) 2905 7888 Fax: + (852) 2854 9596 https://www.charltonsquantum.com |

| Charltons Quantum – 2019 | |