Regulation of Cryptocurrency and Initial Coin Offerings (ICOs) in Australia

AUSTRALIA

ICOs

The Australian Securities & Investments Commission (ASIC) updated its information on ICOs and virtual assets set out in its Information Sheet 225 Initial Coin Offerings and crypto-assets (INFO 225) on 30 May 2019. INFO 225 sets out how the Corporations Act may apply to the raising of funds through an ICO and to other activities involving virtual assets such as cryptocurrencies, tokens or stablecoins.

Under the current regulatory regime, when the virtual asset issued in an ICO is a financial product, the issuer will need to consider and comply with the relevant capital raising provisions of the Corporations Act, Australian financial Services licensing requirements and other regulatory requirements. For non-financial products, no regulatory restraint on capital raising exists but entities are still expected to comply with relevant laws and obligations such as the Corporations Act, ASIC Act, Australian Consumer Law, anti-money laundering (AML) and know your client (KYC) obligations..

ICOs constituting or involving a financial product

The Corporations Act is likely to apply to an ICO that involves a financial product such as a managed investment scheme, security, derivative or non-cash payment (NCP) facility. Australia, like Hong Kong, does not consider Bitcoin to be a financial product.

The key consideration when assessing an ICO’s legal status as a financial product are the rights attached to the virtual assets which are normally set out in the ICO’s ‘white paper’, the offer document issued by the business making the offer or sale of an ICO virtual asset. However, rights (a term which is broadly interpreted to include possible future rights, contingent rights and rights that may not be legally enforceable) can also be determined from other circumstances (e.g., how the ICO or cryptoasset is marketed to potential investors). However, the characterisation of an ICO or crypto asset can evolve over time (i.e., over the course of product development), so it is important that this is monitored, and that ongoing disclosure is made to investors where necessary.[113]

Importantly, whether an ICO constitutes or involves a financial product or not, the Australian Consumer Law applies and so the prohibitions against misleading or deceptive conduct must be adhered to.[114]

Managed investment schemes (MIS)

Types of financial products – Managed Investment Schemes (MIS).

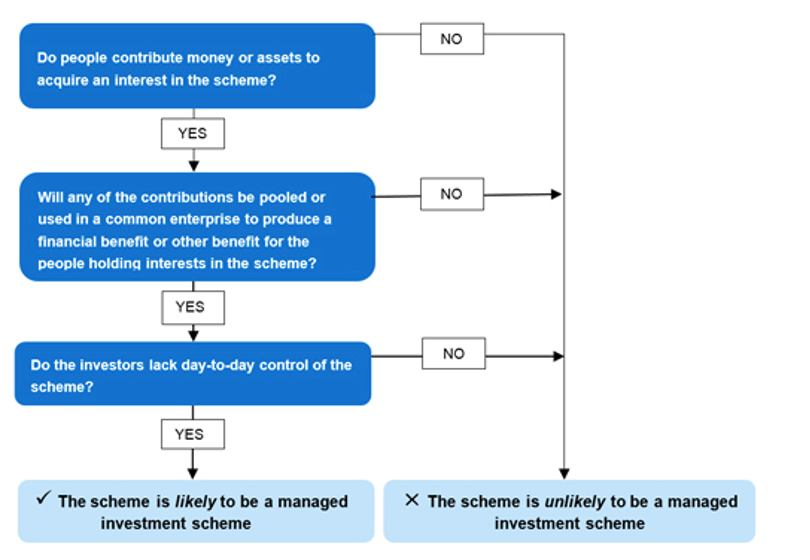

The ASIC has outlined that, in their experience, many ICOs involve interests in a managed investment scheme, which is a form of collective investment vehicle comprised of three elements:

- the contribution of money or assets (e.g., other virtual assets) to acquire an interest in the scheme (which will typically be a type of ‘financial product’ under the Corporations Act);

- any of the contributions are pooled or used in a common enterprise to produce financial benefits or interests in property (e.g., using funds raised from contributors to develop the platform), for purposes that include providing a financial benefit for contributors (e.g., from an increase in the value of their cryptoassets); and

- contributors lack day-to-day control over the operation of the scheme but, at times, may have voting rights or similar rights.

If the rights and value of the virtual assets are related to an arrangement where these three elements are present, the virtual asset issuer is likely to be offering interests in a managed investment scheme. In particular, ASIC has stated that where an ICO issuer frames the entitlements received by contributors as a receipt for a purchased service and the value of the virtual assets acquired is affected by the pooling of funds from contributors, or the use of those funds under the arrangement, then the ICO is likely to be a managed investment scheme. This is particularly likely to be the case where the ICO is offered as an investment.

However, it is not clear in what circumstances an ICO will be deemed to produce a financial or other benefit for those holding interests in the scheme. It would seem to clearly cover the situation where the ICO operates essentially as a tokenised fund – e.g., where the amounts paid by subscribers of the cryptoassets are used to invest in properties or companies and the profits arising from those investments are shared among the holders of the cryptoassets.

It is however less clear whether it would cover the situation in which cryptoasset purchase monies will be used to develop the issuer’s platform which will provide certain services to the holder of the cryptoasset in the future, which will be paid for using the cryptoasset. The questions in that scenario are:

- Would the future services available to holders of the virtual assets constitute a “benefit” which would bring the arrangement within the scope of a “managed investment scheme”?

- If the value of the virtual assets increases such that holders can realise a gain on selling their virtual assets (either on a virtual assets exchange or privately), would this be a “benefit” which would bring the arrangement within the scope of a “managed investment scheme”? The difficulty here is establishing that it is the pooling of the contributions (and the actions of the issuer in developing its platform) which gives rise to the “benefit” (i.e. the rise in value of the virtual assets) for the holders.

Implications where an ICO is a managed investment scheme

In this case, the issuer of the tokens must comply with the registration, licensing and reporting requirements such as, in the case of a retail scheme, registering the scheme with ASIC and obtaining an AFS licence to act as a responsible entity and in the case of a wholesale scheme, obtaining an AFS licence with the appropriate authorisations.[115]

An ICO as an offer of a security

Where an ICO is not a managed investment scheme, it may be considered an offer of a security. This may be the case where an ICO is created to fund a company (or fund an undertaking that looks like a company), in which case, the rights attached to the crypto asset issued in the ICO may fall within the definition of a security, possibly as a share or an option to acquire a share in the future.[116] The prospectus requirements would then apply, as they do to IPOs.

Non-cash Payment Facilities (NCPs)

Non-cash payment facilities (NCPs) are arrangements through which a person makes payments, or causes payments to be made, other than by the physical delivery of currency. These facilities can be a financial product which requires an AFS licence if payments can be made to more than one person.

The ASIC has stated that tokens offered in an ICO are unlikely to be NCPs, although they may be a form of value that is used to make a payment (instead of physical currency). An ICO may involve an NCP facility if it includes an arrangement that allows: payments to be made in a form of value (instead of physical currency) to a number of payees; or payments to be started in a form of value (not a physical currency) and later converted to fiat currency to enable completion of the payment. Generally, an AFS licence may be needed if an ICO involves an NCP facility. In some cases, however, exemptions (e.g., a low-value exemption) may apply.

Financial Market Operation

A financial market is a facility through which offers to acquire or dispose of financial products are regularly made. Where a virtual asset is a financial product (as a security, a managed investment scheme, a derivative or NCP facility), then any platform that enables consumers to buy, be issued with, or sell such a virtual asset may involve the operation of a financial market. In this case, the operator must hold an Australian market licence, unless covered by an exemption. Currently, there are no licensed or exempt platform operators in Australia that enable consumers to buy, be issued with or sell virtual assets that are financial products. Where the crypto assets are not financial products, trading platforms are not subject to the regulatory oversight of the ASIC.

Financial Products that Reference Virtual Assets

Entities may also propose to issue financial products that are linked to, or reference, virtual assets; invest in virtual assets; or otherwise enable consumers to have exposure to virtual assets. In these cases, the entities will be providing a financial service in issuing such financial products and may require a new Australian Financial Services (AFS) licence or licence variation (such as a new product authorisation).

Anti-Money Laundering and Counter-Terrorist Financing

Australia has amended its Anti-Money Laundering and Counter-Terrorism Financing Act of 2006 to regulate the operators of digital currency exchanges. The revised legislation came into effect in April 2018 and requires digital currency exchanges to register with AUSTRAC. Registered exchanges are required to comply with anti-money laundering and counter-terrorist financing obligations.

A digital currency exchange service is one which involves converting crypto assets for fiat currency or fiat currency for crypto assets. Where the service is provided as a business, the exchange needs to be registered as a digital currency exchange with AUSTRAC unless an exemption applies. Exchanges which only exchange crypto assets for other crypto assets are currently outside the scope of the legislation, although that may change in the future.

How Australia’s Regulation Compares to Hong Kong

Generally, Australia and Hong Kong’s regulators take similar approaches to the regulation of virtual assets, in that neither specifically regulate virtual assets except where they constitute “securities” (in Hong Kong) or more generally “financial products” in Australia. The application of Australia’s AML and CTF regime to crypto exchanges is however narrower than is proposed for Hong Kong since crypto-to-crypto exchanges are not currently within the scope of Australian AML/CTF regulation. In Hong Kong, exchanges which trade any virtual asset which is a “security” are already required to be licensed by the SFC and must comply with the AML and CTF obligations for licensed entities. If the proposals for licensing exchanges that trade virtual assets that are not securities go ahead, they too will be subject to AML/CTF compliance, even if they only exchange virtual assets for other virtual assets.

- https://blockchain.bakermckenzie.com/2019/06/17/australian-regulator-provides-update-to-ico-and-crypto-asset-information/#page=1

- https://blockchain.bakermckenzie.com/2019/06/17/australian-regulator-provides-update-to-ico-and-crypto-asset-information/#page=1

- https://asic.gov.au/regulatory-resources/digital-transformation/initial-coin-offerings-and-crypto-assets/#part-c

- https://asic.gov.au/regulatory-resources/digital-transformation/initial-coin-offerings-and-crypto-assets/#part-c